Personal Finance

Our previous experience in the funds management sector means we have an appreciation for the rapport and trust required for individuals and organisations to invest with you, to part with their funds, their savings. Banking is not dissimilar. Banking is personal. It is built on relationships and trust. It is built on understanding and practicing what you preach.

Deeply understanding our clients’ aspirations and goals is our priority. Whether you’re buying a new home, a holiday home, refinancing, renovating, building your once in a lifetime home, investing or reviewing your portfolio, Precision Capital will work with you and your advisors. We will provide well-thought, strategic advice, so that you receive the best possible solutions to support you and your family to grow and create wealth.

Our Services

-

Home and Investment Lending

Fixed rate, variable rate, offset, redraw, cash backs, discounts, lender mortgage insurance (LMI). While there is a lot to get across, Precision Capital has extensive capability in both complex and non-complex, self-employed and PAYG home loans. Our lengthy experience in both home lending and business lending means we will be able to find the right home loan for you.

-

Home and Investment Lending for Medical Professionals

If you are a doctor, specialist, pharmacist or allied health professional and looking to purchase a new home or investment property, you could be eligible to access up to 100%* and 90%* LVR loans respectively and avoid lenders mortgage insurance (LMI). At Precision Capital, we will work with your advisors to ensure we arrange a tax optimal solution that meets your strategic objectives.

-

Refinance

Stop paying the loyalty tax. In some cases, staying loyal to your lender might mean you are paying a higher rate than new customers and so it always pays to ask the question. The property market also looks different now to what it did 12 months ago and so your loan-to-value ratio might have improved warranting a lower interest rate. At Precision Capital, we are constantly in the market and across a range of different lenders and products, so let us ask the question for you. We know what a good deal looks like.

-

Bridging Finance

Timing is everything and sometimes you need to settle on a new home before selling your existing one. As such, a bridging loan may be required to finance the gap between the two transactions, which leverages the value in your existing property and the proposed one. There are alternate ways to approach a change from one home to another and so before going down the rabbit hole of despair, talk to Precision Capital about how we can best support you.

-

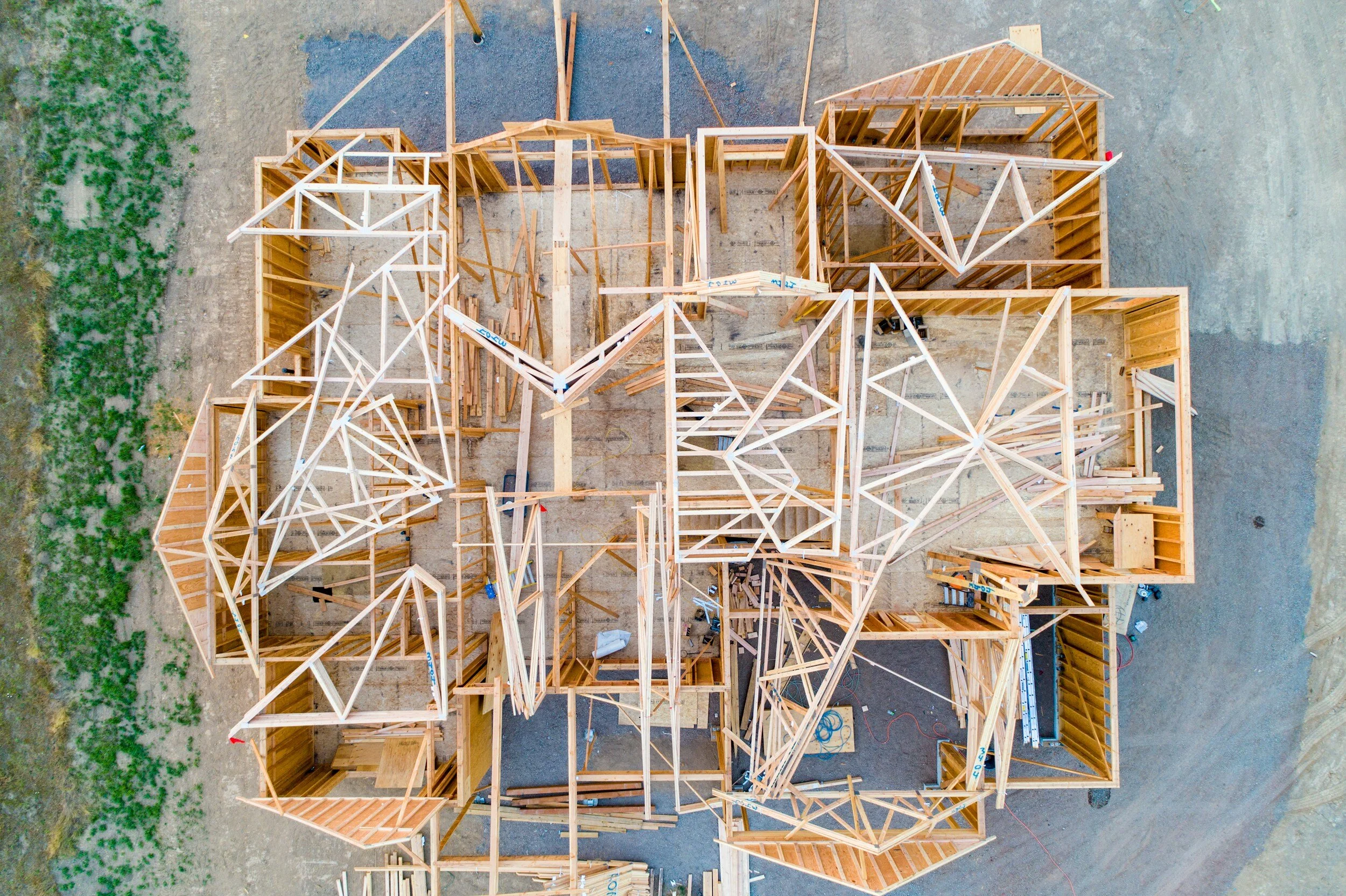

Construction Finance

Managing construction risk is a specialist skill set and at Precision Capital we are fortunate to have deep industry experience in property. We have supported clients to develop townhouses, apartments, multi-million dollar homes, holiday homes and investment properties. Our expertise and industry relationships will ensure we find the right partner and that your project maintains momentum.